Apple Card Customer Agreement Updated for 'Upcoming' Savings Account Feature

Goldman Sachs this week updated its Apple Card customer agreement to reflect the credit card's upcoming Daily Cash savings account feature, which was expected to launch with iOS 16.1 but appears to have been delayed.

"To enable new ways to use Daily Cash like the upcoming Savings account feature, we are updating the Daily Cash Program section of your Apple Card Customer Agreement," reads an email sent to Apple Card holders this week.

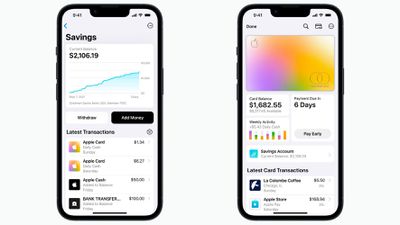

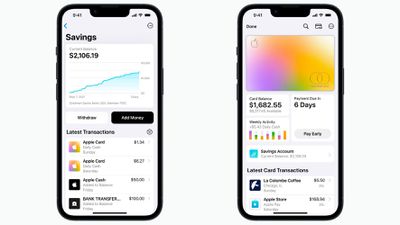

In October, Apple announced that Apple Card users would soon be able to open a new high-yield savings account from Goldman Sachs and have their Daily Cash cashback rewards automatically deposited into it, with no fees, no minimum deposits, and no minimum balance requirements. The account will be managed through the Wallet app on the iPhone.

The savings account was listed in the release notes for the iOS 16.1 Release Candidate, but it did not end up launching with that update. The savings account has not been present in any iOS 16.2 betas, so it's unclear when it will become available, but Goldman Sachs evidently continues to lay the groundwork for the feature's launch.

Once the account is set up, all Daily Cash received from that point on will be automatically deposited into it and start earning interest, unless a user opts to continue having Daily Cash added to their Apple Cash balance. Apple Card provides 2-3% Daily Cash on purchases made with Apple Pay and 1% on purchases made with the physical card.

Launched in 2019, Apple's credit card remains exclusive to the United States. Customers who sign up for an Apple Card and use it to purchase Apple products through December 25 will receive 5% Daily Cash as part of a limited-time promotion.

Popular Stories

Apple is set to unveil iOS 18 during its WWDC keynote on June 10, so the software update is a little over six weeks away from being announced. Below, we recap rumored features and changes planned for the iPhone with iOS 18. iOS 18 will reportedly be the "biggest" update in the iPhone's history, with new ChatGPT-inspired generative AI features, a more customizable Home Screen, and much more....

There are widespread reports of Apple users being locked out of their Apple ID overnight for no apparent reason, requiring a password reset before they can log in again. Users say the sudden inexplicable Apple ID sign-out is occurring across multiple devices. When they attempt to sign in again they are locked out of their account and asked to reset their password in order to regain access. ...

Apple used to regularly increase the base memory of its Macs up until 2011, the same year Tim Cook was appointed CEO, charts posted on Mastodon by David Schaub show. Earlier this year, Schaub generated two charts: One showing the base memory capacities of Apple's all-in-one Macs from 1984 onwards, and a second depicting Apple's consumer laptop base RAM from 1999 onwards. Both charts were...

On this week's episode of The MacRumors Show, we discuss the announcement of Apple's upcoming "Let loose" event, where the company is widely expected to announce new iPad models and accessories. Subscribe to The MacRumors Show YouTube channel for more videos Apple's event invite shows an artistic render of an Apple Pencil, suggesting that iPads will be a focus of the event. Apple CEO Tim...

In his Power On newsletter today, Bloomberg's Mark Gurman outlined some of the new products he expects Apple to announce at its "Let Loose" event on May 7. First, Gurman now believes there is a "strong possibility" that the upcoming iPad Pro models will be equipped with Apple's next-generation M4 chip, rather than the M3 chip that debuted in the MacBook Pro and iMac six months ago. He said a ...

Apple has announced it will be holding a special event on Tuesday, May 7 at 7 a.m. Pacific Time (10 a.m. Eastern Time), with a live stream to be available on Apple.com and on YouTube as usual. The event invitation has a tagline of "Let Loose" and shows an artistic render of an Apple Pencil, suggesting that iPads will be a focus of the event. Subscribe to the MacRumors YouTube channel for more ...

Top Rated Comments

You are also ignoring interest rate risk inherent with not holding a bill or bond for full term. If you bought 1 yr bills six months ago you have lost badly. In fact, you have less than when you started. $1 in t-bills bought six months ago is worth 97 cents right now and that does not even consider transaction costs. There is an inverse relationship between interest rates and principal value. One goes up, the other goes down.

It is also unlikely someone dealing in minimum denominations can tie their money up for the periods required. Oops, I need that money next Friday because my water heater failed and it is December and this isn't Florida. What do you mean? Fine, but you are only getting 97 cents back for each dollar you put it.

A simple interest savings account is often the instrument of choice due to convenience, liquidity and zero or close to it transaction costs.

Your statement is so generalized that its value is questionable. Every individual's situation and constraints are different. There is no "one size fits all" with this which is why professional advice is important.

I get it and employ similar strategies. Much of that behavior is enabled by my personal finances and what I have managed to accumulate and the fact most of my financial responsibilities to others have been satisfied leaving me with less constraints and a higher level of liquidity. It's just not practical for most people.